29+ mortgage interest tax credit

Web An MCC is a federal tax credit given by the IRS to low-income borrowers and its typically reserved for first-time home buyers. Web Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy build or.

Hfsf Hdb Ag Swiss Hrb 68648 Market Efta Germany Greece Cross Border I

Web Home mortgage interest.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad Taxes Can Be Complex. Web The exact amount of the tax credit is based on a formula that takes into account the mortgage loan the interest rate and the MCC percentage.

Apply Get Pre-Approved Today. Web About Form 8396 Mortgage Interest Credit If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

For married taxpayers filing separate returns the cap. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who are married but filing.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Qualified homebuyers can claim a tax credit that. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web The Tax Cuts and Jobs Act made three changes to the tax code that limit the mortgage interest deduction for homeowners taking out mortgages or refinancing in. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Homeowners who bought houses before.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. You can claim a tax deduction for the interest on the first. Lock Your Rate Today.

Web The mortgage interest credit for a tax year is calculated on Form 8396 Mortgage Interest Credit by multiplying the mortgage interest the taxpayer paid or. Ad Taxes Can Be Complex. Get Instantly Matched With Your Ideal Mortgage Lender.

MCCs are certiicates issued by HFAs that increase the federal tax beneits of owning a home and helps low- and moderate-income irst-time. Web a federal tax credit. Ad Rates as Low as 724 APR For 1 Year with No Closing Costs for Lines up to 500k.

Great Rates Flexible Terms Close from the Comfort of Your Own Home. Ad Compare the Best Home Loans for February 2023. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

However higher limitations 1. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The mortgage credit certificate program is designed to help low-income first-time homebuyers afford homeownership.

Web A mortgage calculator can help you determine how much interest you paid each month last year. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. When you receive an MCC you can.

Web Mortgage Tax Credit - Allstate Calculator Skip to main content Explore Allstate Español Log in get a quote Insurance more Insurance more Vehicle Auto Motorcycle ATVoff.

Mortgage Interest Deduction Bankrate

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Premium Photo House And Tax Tax Interest On Purchase Or Sale Fees And Duties Deductions And Concessions Grace Periods Subsidies Objects Of Taxation Refunds Savings In Real Estate Maintenance

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction How It Calculate Tax Savings

Premium Vector Interest Rates Increase Due To The Increase In Inflation Risk Of Debt Burden From High Interest Rates Invest In Short Term Bonds Businessmen Interest Bearing Walk Up The High

![]()

Premium Vector Mortgage House Loan Refinance Icon

Premium Vector Inflation Or Interest Rate Causing Economic Recession Tax Or Loan Payment Trouble Stock Market And Crypto Currency Crisis Concept Businessman Investor Running From Exploding Percentage Bomb

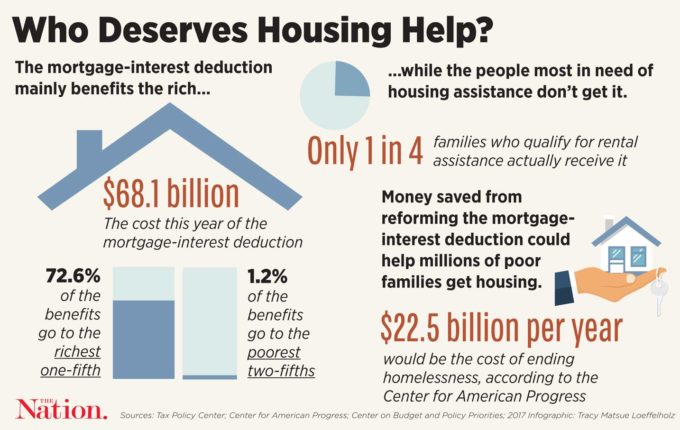

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

Ebit Calculation Examples Of Ebit Earnings Before Interest And Taxes

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Premium Vector Interest And Household Debt Monthly Debt Payment Home Loan Housing Loan Car Loan Personal Businessman With House Car Credit Card Utilities Cost On Back